- Elizabeth Larson

- Posted On

The presidential inauguration: Country's pivotal ceremony has fascinating history

When Barack Obama stands before the nation on Tuesday to be sworn in at the 44th president of the United States, he'll be at the center of a centuries-old ceremony invested with ideals, hopes and symbols.

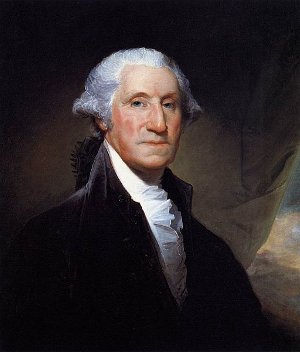

Presidential inaugurations have been going on since 1789, when George Washington took his oath as the nation's first president.

But the ceremony in which Washington was invested with the country's leadership has changed, evolved and been refined over the years, with each of his presidential successors adding a special touch to reflect their own vision of the country they were to lead.

Obama's inaugural event could end up being the largest, with the National Mall thrown open to the millions of people estimated to be in the nation's capitol for the event.

People from around the country – including several from Lake County – are making the trek to Washington, DC because of the desire to see the first president of African descent begin his tenure as the nation's head.

The ceremony will take place on the US Capitol Building's West Portico, facing out toward the National Mall, at noon Eastern Standard Time, and 9 a.m. on the West Coast.

So, how has the ceremony developed, and how has it changed? Let's take a brief look at the ceremony, with the help of historical documents from the Library of Congress and the Joint Congressional Committee on Inaugural Ceremonies.

Presidential inaugurals: The early days

General George Washington was said to have been offered the kingship of the fledgling United States, a country that sought to sever itself from King George III's British sovereignty.

But Washington, who had fought hard to see the new nation on its own, turned down that offer, and instead taken part in a search for a proper name for the country's new chief executive and the proper form of the accompanying ceremonies.

Washington's popularity was such that he was was elected to two terms, in 1789 and 1792, running unopposed both times and getting 100 percent of the Electoral College vote, the only president ever to have that distinction.

When it came time for his inauguration, it was a ceremony very different from that which will be witnessed by the world this Jan. 20.

George Washington was inaugurated on April 30, 1789, in a formal ceremony that took place at Federalist Hall before a joint session of Congress in New York City, then the nation's capitol, according to a history of the event provided by the Joint Congressional Committee on Inaugural Ceremonies.

Histories of the event say he was led into the chamber and seated in a chair that faced Congress, with the House on one side and the Senate on another, according to an account of the event provided by Eyewitness to History's Web site.

After a brief address from Vice President John Adams, the swearing-in itself took place on a balcony overlooking Wall Street, with Robert Livingston, chancellor of State of New York, administering the oath. Afterward the crowd was said to have let out three big cheers for the new president, who then went back inside to give his inaugural address.

By the time Washington was inaugurated again four years later, on March 4, 1793, the ceremony already was undergoing modifications.

For one, the ceremony moved from New York to Philadelphia, and the oath was administered by Supreme Court Associate Justice William Cushing.

Rather than an April swearing-in, the ceremony month moved to March, which would remain the time of the ceremony until Franklin Roosevelt's first swearing-in on Jan. 20, 1937. Only when presidents died did the ceremony deviate from the regular schedule.

Unique men, unique touches

When Washington's successor, John Adams, was sworn in on March 4, 1797, the ceremony remained in Philadelphia. It was an event that proved the United States' leaders would peacefully relinquish and transfer authority at the bidding of the citizens.

Adams was the first president to take the oath of office from a chief justice, in this case Oliver Ellsworth.

In 1801, Adams' successor and, at the time, bitter rival, Thomas Jefferson, also would employ the chief justice in his ceremony.

In a March 2, 1801, letter to Chief Justice John Marshall, Jefferson wrote that he intended to take the oath of office on March 4, 1801, in the senate chambers.

"May I hope the favor of your attendance to administer the oath?" he wrote in the letter, found today in the Library of Congress.

He also asked Marshall, "I would pray you in the mean time to consider whether the oath prescribed in the constitution be not the only one necessary to take? It seems to comprehend the substance of that prescribed by the act of Congress to all officers, and it may be questionable whether the legislature can require any new oath from the President."

Marshall received the letter and wrote back the same day, March 2. "I shall with much pleasure attend to administer the oath of office on the 4th, and shall make a point of being punctual."

As to the oath itself, "The records of the office of the department of state furnish no information respecting the oaths which have been heretofore taken," Marshall wrote. "That prescribed in the constitution seems to me to be the only one which is to be administered. I will however enquire what has been the practice."

Marshall would go on to administer the oath of office nine times for presidents Thomas Jefferson, James Madison, James Monroe, John Quincy Adams and Andrew Jackson – the most times a chief justice has participated in inaugurations since.

Jefferson's inaugural was the first to take place in Washington, DC, in the US Capitol's Senate chamber.

In 1809, the presidential inauguration had its first inaugural ball, on the evening of Saturday, March 4, the same day as President James Madison was sworn in. Tickets to the event, held at Long's Hotel, cost $4 each, according to the Joint Congressional Committee on Inaugural Ceremonies.

Other presidents would bring their own unique touches. President John Quincy Adams took his oath on a volume of law on Friday, March 4, 1825, the first president to wear long trousers rather than knee breeches.

For his March 4, 1837, inaugural, Martin Van Buren would ride to the US Capitol with his predecessor, Andrew Jackson, the first time outgoing and incoming presidents traveled together.

William Henry Harrison would be the first president to arrive in the capitol by train for his 1841 ceremony. The accompanying ball and parade were planned by the first citizens inaugural committee to form.

Harrison gave the longest inaugural address in history – 8,445 words, compared to the shortest, 133 words which Washington gave at his second inaugural. Harrison would die a month later of pneumonia, which historians believe came about due to his exposure to bad weather at the inaugural.

His death was the first for a sitting president. His vice president, John Tyler, would take the oath from Chief Judge of the US District Court William Cranch in a private ceremony at the Brown's Hotel on Pennsylvania Avenue.

James K. Polk's 1845 inaugural ceremony would be the first one reported over a telegraph and the first depicted in a newspaper illustration in the Illustrated London Times.

Franklin Pierce affirmed his 1853 oath but didn't swear it, and is said to have recited his 3,329-word address from memory. The 1857 ceremony of his successor, James Buchanan, was the first to be photographed.

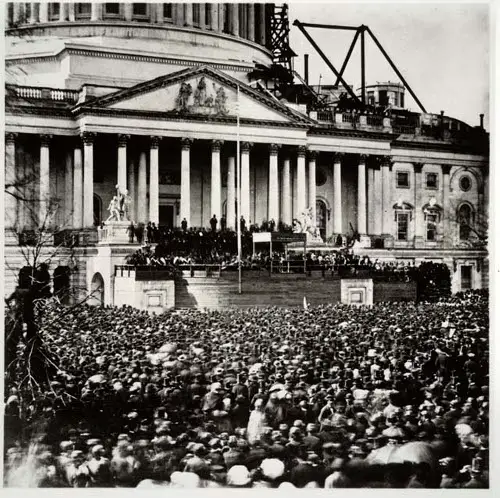

In 1861, with the Civil War about to break out, Abraham Lincoln's inaugural was marked by a procession surrounded by armed cavalry and infantry, with riflemen perched in the US Capitol's windows.

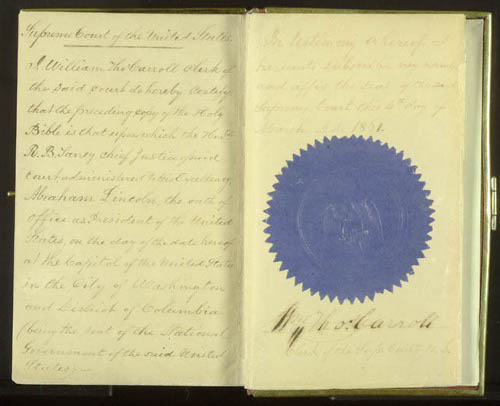

Wearing his trademark top hat, Lincoln was sworn in by Chief Justice Roger B. Taney on a Bible purchased by William Thomas Carroll, clerk to the Supreme Court. During his second inaugural four years later, blacks marched for the first time in the inaugural parade.

Moving pictures made their debut at William McKinley's 1897 inaugural, the first recorded on a movie camera. For McKinley's second inaugural, the Joint Congressional Committee on Inaugural Ceremonies was first formed to arrange the ceremonies.

Theodore Roosevelt, at 42, became the youngest president in history in September 1901 when McKinley was assassinated. Roosevelt's first swearing-in took place in Buffalo, New York, where he was said to not have used a Bible or any other book during the brief oath.

William Taft would be accompanied by his wife, Helen, on the return ride from the US Capitol to the White House after his 1909 inaugural. Following his one term as president, Taft would become chief justice of the US Supreme Court, and in that capacity would administer the oath of office to Calvin Coolidge in 1925 and Herbert Hoover in 1929.

President Woodrow Wilson's wife, Edith, rode with him to and from the US Capitol for the inaugural in 1917, a year that also marked the first time the inaugural parade included women participants.

The first president to make his way to and from his inauguration in an automobile was Warren Harding in 1921. Harding also honored Washington by using the same Bible for his swearing-in – owned by St. John's Masonic Lodge, No. 1 – as Washington used in 1789.

Calvin Coolidge's 1925 inaugural had the distinction of being the first to be nationally broadcast on the radio. For Herbert Hoover's ceremony four years later, the event was recorded by a talking newsreel.

Franklin Roosevelt and wife, Eleanor, would add attendance at a morning worship service to inauguration day solemnities in 1933.

That same year, the 20th Amendment to the US Constitution was adopted; it set the time for inaugurals at noon Eastern Standard Time, and moved the date permanently to Jan. 20. Roosevelt's second inaugural in 1937 would take place in January; that event also would be the first time that a vice president – in this case, John Nance Garner – would be sworn in at the same ceremony, a practice which continues today.

Harry Truman's 1949 inaugural was the first to be broadcast on national television.

In 1953, Dwight Eisenhower used the Bible Washington used in his first inaugural, which Harding also had used.

John F. Kennedy, the first Roman Catholic president, added poetry to the inaugural – famed poet Robert Frost read a poem for the occasion at the 1961 event.

The next swearing-in ceremony took place far from Washington, DC. On Nov. 22, 1963, Lyndon Johnson took the oath of office from the only woman ever to administer it – Sarah T. Hughes, a US district judge of the Northern District of Texas – in the conference room aboard Air Force One at Love Field, Dallas, Texas. John F. Kennedy had been fatally shot earlier that day.

Historian Michael R. Beschloss' book "Taking Charge: The Johnson White House Tapes, 1963-1964," recounts Johnson as saying he spoke with Robert F. Kennedy shortly after President Kennedy's assassination. Robert Kennedy, according to Johnson, urged him to take the oath of office immediately, an account disputed in William Manchester's book, "The Death of a President."

On Aug. 9, 1974, Gerald Ford took the oath of office in the White House after Richard Nixon became the only president to ever resign from office.

The inauguration would move to the west front of the US Capitol in 1981, with Ronald Reagan's swearing-in. Reagan would have the distinction of having the warmest and coldest inaugural days on records – 1981 and 1985 respectively.

Another innovation would be introduced to the ceremonies in 1997, when Bill Clinton's inauguration would be broadcast live on the Internet for the first time.

Obama's event has special touches of its own

Prior to Barack Obama taking the oath of office on Tuesday, his vice president, Joe Biden, will be sworn in by Supreme Court Justice John Paul Stevens.

Chief Justice John Roberts then will lead Obama through the 35-word oath, an honor chief justices have had since 1797. It will be the 69th time the oath has been given, according to Library of Congress records.

Obama will call on history in adding his own special touches to the ceremony.

He identifies strongly with Lincoln – another president from Illinois – and so will lay his hand on Lincoln's 1861 inaugural Bible as he takes the oath of office prescribed in the US Constitution's Article II, Section I: “I do solemnly swear (or affirm) that I will faithfully execute the office of President of the United States, and will to the best of my ability, preserve, protect and defend the Constitution of the United States.”

Following the swearing-in, Obama will give his much-anticipated inauguration speech, and afterward he and Biden will travel back to the White House to view the inaugural parade and begin a daylong celebration that will include inaugural balls in the evening.

The inauguration and its accompanying events officially conclude on Wednesday morning, with a national prayer service at the Washington National Cathedral.

E-mail Elizabeth Larson at This email address is being protected from spambots. You need JavaScript enabled to view it..

{mos_sb_discuss:3}

How to resolve AdBlock issue?

How to resolve AdBlock issue?